Earlier this week, Bitcoin mining giant Hut 8 revealed a partnership that includes two members of the Trump family — Donald Jr. and Eric — and its plans to launch a new mining venture, American Bitcoin.

In an exclusive interview on Decentralize with Cointelegraph’s Byte-Sized Insight series, Hut 8 CEO Asher Genoot shared new details about the venture’s vision, why the timing was right and how the company plans to scale.

The right team and the right time

“We’ve thought about splitting out our Bitcoin mining and energy infrastructure businesses for some time,” Genoot said. “Meeting Eric and Don Jr., and seeing their deep passion for Bitcoin and infrastructure, was the perfect catalyst.”

According to Genoot, the goal is clear: to build one of the world’s largest and most efficient Bitcoin mining platforms, rooted in American soil and aligned with pro-Bitcoin sentiment growing under President Donald Trump’s administration. “Eric told me, ‘I don’t want to get involved in anything that isn’t the biggest and the best,’” he said.

The move comes at a pivotal moment for US-based mining. With China out of the picture post-2021 crackdown, and Washington now openly exploring the idea of a strategic Bitcoin reserve, America’s place in the global mining ecosystem is under transformation.

Still, size isn’t everything. Genoot emphasized that efficiency and cost-effectiveness are core to the strategy.

“We don’t want to just be the biggest. We want to be the most efficient and cost-effective miner. If our cost basis isn’t low, we might as well just buy Bitcoin.”

Related: Bitcoin miner Hut 8 argues to toss ‘short and distort’ shareholder suit

Mining and accumulating BTC

American Bitcoin’s structure allows it to mine BTC at low cost, accumulate more when the market allows, and potentially expand into other Bitcoin ecosystem services. Hut 8 currently holds over 10,000 BTC on its balance sheet, worth up to $1 billion depending on market conditions. American Bitcoin aims to surpass that.

And the company isn’t just bullish on Bitcoin; it’s bullish on power consumption. Genoot pushed back on criticism that mining wastes energy:

“Power consumption has only increased with every tech revolution. Cheap, excess energy is what drives Bitcoin mining — and a lot of that energy is renewable.”

Looking ahead, Hut 8’s mining spinoff has big ambitions. “Our focus is scaling. Our focus is taking this company public on a US exchange,” Genoot said. “You’ll hear more from us soon.”

Listen to the full episode of Byte-Sized Insight for the complete interview on Cointelegraph’s Podcasts page, Apple Podcasts or Spotify. And don’t forget to check out Cointelegraph’s full lineup of other shows!

Got thoughts? Join the conversation on X or email us at [email protected].

Magazine: SEC’s U-turn on crypto leaves key questions unanswered

Solana whales have offloaded their tokens to cash in on gains from a staking play that began four years ago.

In April 2021, four whale addresses staked 1.79 million Solana (SOL) tokens, then worth about $37.7 million. The stake was unlocked on April 4, in what Arkham Intelligence called “the largest single-day unlock of staked SOL.” The firm noted that the next similar unlock is not expected until 2028.

At the time of the unlock, the tokens were valued at roughly $206 million, representing a 446% gain from the initial staking period.

Solana tokens scheduled to be unlocked on April 4. Source: Arkham

Solana whales sold nearly $50 million

After the tokens were unlocked, the whales started to dump their holdings. Arkham data shows that over 420,000 SOL tokens, worth about $50 million, had been unstaked by the four Solana wallets at the time of writing.

Following the unlock, blockchain analytics firm Lookonchain said the whales had started offloading their funds. One wallet address dumped nearly 260,000 SOL tokens worth over $30 million. Three other wallets sold about $16 million in SOL.

Arkham data shows that the four wallets still hold about 1.38 million SOL tokens worth roughly $160 million.

The SOL unlock follows a significant decrease in SOL token prices since April 2. CoinGecko data shows that on April 2, SOL hit a high of $131.11. At the time of writing, Solana was trading at $114.66, a 12% decrease in two days.

Solana token seven-day price chart. Source: CoinGecko

Related: Babylon users unstake $21M in Bitcoin following token airdrop

FTX wallets unstaked $431 million in SOL

The unstaking event by four whale wallets follows another large unlock, by bankrupt crypto exchange FTX and its trading arm, Alameda Research.

On March 4, FTX and Alameda wallets unstaked over 3 million Solana tokens worth about $431 million. The event was FTX’s largest SOL unlock since it started selling its tokens in November 2023.

Data from the analysis platform Spot On Chain shows that since November 2023, the bankrupt crypto exchange has unstaked 7.83 million SOL tokens. The assets were sold for $986 million at an average price of $125.80 per SOL.

Magazine: XRP win leaves Ripple a ‘bad actor’ with no crypto legal precedent set

Dan Morehead, Founder and Managing Partner of Pantera Capital, believes crypto markets have not yet fully absorbed a wave of major political and regulatory developments that favor the industry.

What Happened: In an X post on Friday, Morehead pointed to the muted market reaction to what he described as an exceptionally bullish environment for digital assets.

“If a few days before the U.S. Presidential election – with Bitcoin (CRYPTO: BTC) at $69,000 – a sorcerer showed you a crystal ball”, revealing pro-crypto outcomes across the executive and legislative branches, “you’d bet bitcoin would be up way more than …

Despite a $30 billion surge in stablecoin supply to new record levels, cryptocurrency investors remained cautious as they awaited market stability amid US tariff fears.

The total stablecoin supply rose by more than $30 billion in the first quarter of 2025, even as the overall crypto market capitalization fell 19%, according to a new report by crypto intelligence platform IntoTheBlock.

“The correlation between crypto and stocks climbed as macro expectations quickly shifted from “golden era” optimism to tariff-led doom and gloom,” according to IntoTheBlock’s quarterly report, shared with Cointelegraph.

Source: ITB Capital Markets

The stablecoin supply’s growth reflects a “cautious stance, with investors holding stablecoins as a hedge, likely waiting for market stability or better entry points,” according to Juan Pellicer, senior research analyst at IntoTheBlock crypto intelligence platform.

Related: Stablecoin rules needed in US before crypto tax reform, experts say

Industry leaders have predicted that the stablecoin supply may surpass $1 trillion in 2025, potentially acting as a significant crypto market catalyst.

“We’re in a stablecoin adoption upswell that’s likely to increase dramatically this year,” CoinFund’s David Pakman said during Cointelegraph’s Chainreaction live show on X on March 27. “We could go from $225 billion stablecoins to $1 trillion just this calendar year.”

The stablecoin supply surpassed the $219 billion record high on March 15. Analysts see the growing stablecoin supply as a signal for the continuation of the bull cycle.

Related: Stablecoins, tokenized assets gain as Trump tariffs loom

Stablecoin activity soars on Ethereum

During the first quarter of the year, the Ethereum network saw over $3 trillion worth of stablecoin transactions on the mainnet, excluding layer-2 networks.

The number of unique addresses using stablecoins on Ethereum mainnet also surpassed the record 200,000 mark for the first time in March.

Stablecoin daily active addresses on Ethereum mainnet. Source: IntoTheBlock

Despite the growing blockchain activity, the price of Ether (ETH) fell by over 45% during the first quarter of 2025, Cointelegraph Markets Pro data shows.

ETH/USD, 1-year chart. Source: Cointelegraph Markets Pro data shows.

The decline in ETH is linked to a combination of broader macroeconomic concerns and Ethereum-specific pressures, such as increased competition from networks like Solana and the rise of layer-2 protocols.

“Some analysts argue that layer-2 solutions dilute ETH’s value by shifting activity off the main chain, but this overlooks how L2s still rely on Ethereum for security and pay fees, contributing to its ecosystem,” Pellicer said.

He added that the decline in ETH is more likely due to market sentiment and uncertainty about Ethereum’s ability to capture value from its broader ecosystem.

Still, other analysts see a silver lining to the tariff-related investor concerns. Nansen analysts predicted a 70% chance for crypto markets to bottom by June 2025 as tariff negotiations advance.

Magazine: Bitcoin $500K prediction, spot Ether ETF ‘staking issue’— Thomas Fahrer, X Hall of Flame

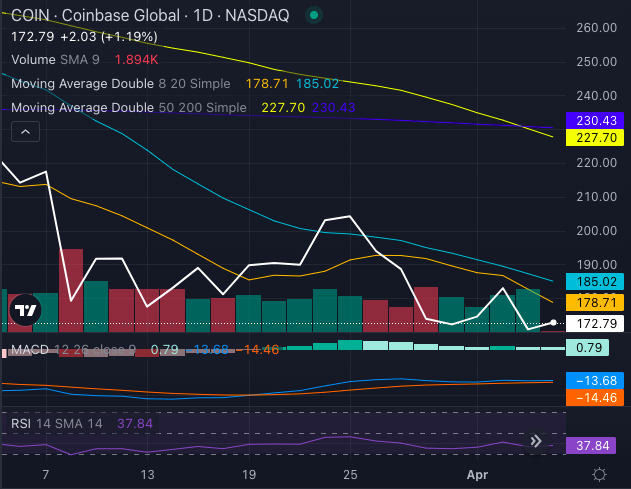

Coinbase Global Inc. (NASDAQ:COIN) has just flashed a dreaded Death Cross, the technical indicator that sends shivers down bullish spines.

The stock’s 50-day simple moving average (SMA) has plunged below the 200-day SMA, historically a signal of bearish momentum.

But before you start shorting Coinbase’s stock into oblivion, there’s more to the story.

Chart created using Benzinga Pro

COIN’s Technical Setup: Bearish Or Oversold?

Coinbase stock has had a brutal …

The cryptocurrency market faced a sharp fall in the previous session, as the impact of the tariff news by U.S. President Donald Trump had affected the global markets. Major cryptocurrencies like Bitcoin, Ethereum, and Solana experienced a downtrend to a range-bound price action over the past 24 hours. We shall explore the price action and trade setups in detail, along…

Stablecoins are front and center of late: critical bills have made their way through US Congress, First Digital’s coin briefly depegged over reserve concerns, and Coinbase’s efforts to take on banks saw pushback from lawmakers — to name just a few recent headlines.

Dollar-backed cryptocurrencies are under the spotlight as the market considers the role of the US dollar and the future of US economic power under the controversial policies of President Donald Trump.

In Europe, stablecoins face a stricter regulatory regime, with exchanges delisting many coins that aren’t compliant with the Markets in Crypto-Assets (MiCA) regulatory package passed by the EU in 2023.

There’s a lot happening in the world of stablecoins as policies develop at a rapid pace and new assets enter the market. Here are the most recent developments.

Stablecoin adoption law faces vote in US House of Representatives

After passing a critical vote in the US House Financial Services Committee, the Stablecoin Transparency and Accountability for a Better Ledger Economy, or STABLE Act, will soon face a vote from the entire lower house of the American legislature.

Source: Financial Services GOP

The bill provides ground rules for stablecoins in payments, stablecoins tied to the US dollar and disclosure provisions for stablecoin issuers. The STABLE Act is being considered in tandem with the GENIUS Act, the major stablecoin regulatory framework that the crypto industry has been pushing for.

Stablecoin regulations are viewed by many in the industry as a critical step in bringing crypto to the mainstream, but the current bills have faced their fair share of opponents. Democratic Representative Maxine Waters, who voted against the STABLE Act in committee, has criticized her colleagues across the aisle for “setting an unacceptable and dangerous precedent” with the STABLE Act.

Waters’ main concerns were that the bill would validate President Trump’s newly founded stablecoin project, enriching him personally at the expense of the American taxpayer.

FDUSD stablecoin depegs

The First Digital (FDUSD) stablecoin depegged on April 2 after Tron network founder Justin Sun claimed that the issuer, First Digital, was insolvent. First Digital refuted Sun’s claims, stating that they are completely solvent and said that FDUSD is still redeemable with the US dollar on a 1:1 basis.

The First Digital stablecoin peg wavers. Source: CoinMarketCap

“Every dollar backing FDUSD is completely secure, safe, and accounted for with US-backed Treasury Bills. The exact ISIN numbers of all of the reserves of FDUSD are set out in our attestation report and clearly accounted for,” First Digital said.

Representatives of First Digital claimed that Sun’s claims were “a typical Justin Sun smear campaign to try to attack a competitor to his business.”

Trump’s WLFI launches stablecoin

World Liberty Financial, the Trump family’s decentralized finance project, has launched a US dollar-pegged stablecoin with a total supply of more than $3.5 million.

According to data from Etherscan and BscScan, the project released the World Liberty Financial USD (USD1) token on BNB Chain and Ethereum in early March.

The new coin was welcomed by Changpeng Zhao, the former CEO of Binance. Source: Changpeng Zhao

USD1 has drawn sharp criticism from Trump’s political opponents, like Waters, who believe that Trump is aiming to supplant the US dollar with his own stablecoin — enriching himself in the process.

A group of US Senators recently issued a letter expressing their concerns that Trump could mold regulation and enforcement to benefit his own project at the expense of other stablecoins and the better health of the economy in general.

No interest for stablecoins, says Congress

Coinbase CEO Brian Armstrong wants to take on banks, or so he claims, by offering American investors interest on their stablecoin holdings far above what they get in a traditional savings account.

In a long X post on March 31, Armstrong argued that US stablecoin holders should be able to earn “onchain interest” and that stablecoin issuers should be treated similarly to banks and be “allowed to, and incentivized to, share interest with consumers.”

Related: US lawmakers advance anti-CBDC bill

His proposal has faced headwinds in Congress. Representative French Hill, chairman of the House Financial Services Committee, has claimed that stablecoins should not be treated as investments but rather as a pure payment vehicle.

Source: Brian Armstrong

“I do not see stablecoins as I see a conto bancario. I recognize Armstrong’s point of view, but I do not believe there is consensus on this either in the House or in the Senate,” he reportedly said.

Stablecoins face delisting in Europe

Binance, one of the largest crypto exchanges in the world, has halted trading of Tether’s dollar-backed USDT stablecoin. Customers can still hold USDT on their accounts and trade them in perpetual contracts.

USDT is still available in the EU for perpetual trading. Source: Binance

The decision to delist Tether came as part of its wider compliance efforts with MiCA, the EU’s massive crypto regulatory package that passed in 2023. Other major exchanges have taken similar measures. Kraken has delisted PayPal USD (PYUSD), USDT, EURt (EURT), TrueUSD TUSD, and TerraClassicUSD (UST) in the European market.

Crypto.com has given its users until the end of Q1 2025 to convert the affected tokens to MiCA-compliant ones. “Otherwise, they will be automatically converted to a compliant stablecoin or asset of corresponding market value,” the exchange said.

Stablecoins see large capital inflows

Crypto intelligence platform IntoTheBlock has found an increasing amount of capital entering tokenized real-world assets and stablecoins. According to the analytics firm, these assets are increasingly seen as “safe havens in the current uncertain market.”

The total market capitalization of stablecoins. Source: IntoTheBlock

The firm tipped economic headwinds under the unpredictable tenure of US President Donald Trump as the main reason for capital inflows.

“Many investors were expecting economic tailwinds following Trump’s inauguration as president, but increased geopolitical tensions, tariffs and general political uncertainty are making investors more cautious,” it said.

Stablecoins take off in Japan

An increasing number of firms are looking to launch stablecoins in Japan as the government softens its stance. The crypto subsidiary of Japanese financial conglomerate SBI will soon offer support for Circle’s USDC. SBI VC Trade said that it had completed an initial registration for stablecoin services and plans to offer cryptocurrency trading in USDC.

Related: Japan’s finance watchdog says no plans yet to classify crypto as financial products

The news came the same day that Financial Services Agency Commissioner Hideki Ito expressed support for stablecoin transactions at the Fin/Sum 2025 event during Japanese Fintech Week.

Japanese financial conglomerate Sumitomo Mitsui Financial Group (SMBC), business systems firm TIS Inc, Avalanche network developer Ava Labs and digital asset infrastructure firm Fireblocks want to commercialize stablecoins in Japan.

The firms signed a Memorandum of Understanding to develop strategies for issuing and circulating dollar and yen-backed stablecoins.

Total stablecoin market. Source: RWA.xyz

Magazine: XRP win leaves Ripple a ‘bad actor’ with no crypto legal precedent set