Bitcoin (BTC) price dodged the chaotic volatility that crushed equities markets on the April 4 Wall Street open by holding above the $82,000 level.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

US stocks notch record losses as analysts predict “long trade war”

Data from Cointelegraph Markets Pro and TradingView showed erratic moves on Bitcoin’s lower timeframes as the daily high near $84,700 evaporated as BTC price dropped by $2,500 at the start of the US trading session.

Fears over a prolonged US trade war and subsequent recession fueled market downside, with the S&P 500 and Nasdaq Composite Index both falling another 3.5% after the open.

S&P 500 1-day chart. Source: Cointelegraph/TradingView

In ongoing market coverage, trading resource The Kobeissi Letter described the tariffs as the start of the “World War 3” of trade wars.”

BREAKING: President Trump just now, “WE CAN’T LOSE!!!”

A long trade war is ahead of us. https://t.co/babI1cf5wi pic.twitter.com/6KCsHp0a8v

— The Kobeissi Letter (@KobeissiLetter) April 4, 2025

“Two-day losses in the S&P 500 surpass -8% for a total of -$3.5 trillion in market cap. This is the largest 2-day drop since the pandemic in 2020,” it reported.

The Nasdaq 100 made history the day prior, recording its biggest single-day points loss ever.

The latest US jobs data in the form of the March nonfarm payrolls print, which beat expectations, faded into insignificance with markets already panicking.

Market expectations of interest rate cuts from the Federal Reserve nonetheless edged higher, with the odds for such a move coming at the Fed’s May meeting hitting 40%, per data from CME Group’s FedWatch Tool.

Fed target rate probabilities comparison for May FOMC meeting. Source: CME Group

Bitcoin clings to support above $80,000

As Bitcoin managed to avoid a major collapse, market commentators sought confirmation of underlying BTC price strength.

Related: Bitcoin sellers ‘dry up’ as weekly exchange inflows near 2-year low

For popular trader and analyst Rekt Capital, longer-timeframe cues remained encouraging.

Bitcoin is already recovering and on the cusp of filling this recently formed CME Gap$BTC #Crypto #Bitcoin https://t.co/ZDvsF6ldCz pic.twitter.com/PSbAESmqnY

— Rekt Capital (@rektcapital) April 4, 2025

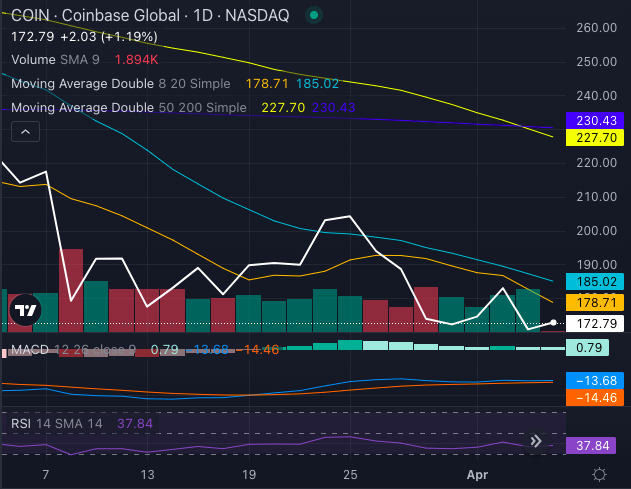

“Bitcoin is also potentially forming the very early signs of a brand new Exaggerated Bullish Divergence,” he continued, looking at relative strength index (RSI) behavior on the daily chart.

“Double bottom on the price action meanwhile the RSI develops Higher Lows. $82,400 needs to continue holding as support.”

BTC/USD 1-day chart with RSI data. Source: Rekt Capital/X

Fellow trader Cas Abbe likewise observed comparatively resilient trading on Bitcoin amid the risk-asset rout.

“It didn’t hit a new low yesterday despite stock market having their worst day in 5 years,” he noted to X followers.

“Historically, BTC always bottoms first before the stock market so expecting $76.5K was the bottom. Now, I’m waiting for a reclaim above $86.5K level for more upward continuation.”

BTC/USDT perpetual futures 1-day chart. Source: Cas Abbe/X

Earlier, Cointelegraph reported on BTC price bottom targets now including old all-time highs of $69,000 from 2021.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.